30+ Fha loan first time home buyer

FHA loans have lower credit and down payment requirements for qualified homebuyers. 100 Financing plus low down payment.

Home Loans St Louis Real Estate News

Take advantage of these Texas first-time home buyer programs as well as national home buyer programs.

. They allow borrowers to finance homes with down payments as low as 35 and are especially popular with first-time homebuyers. For basic loan options you wont find VA FHA or USDA loans here Ally offers competitive rates and standard lender fees which range from 2 to 5 of the loan. Most home buyers choose a 30-year fixed-rate mortgage which has equal payments over the life of the loan.

An FHA Loan is a mortgage thats insured by the Federal Housing Administration. Borrowers can roll closing costs into their loans. For instance while the CalPLUS Conventional Program comes with a slightly higher 30-year fixed rate than the CalPLUS FHA loan.

Foreclosure waiting period is measured from the date of title transfer. Note- FHA eligibilty is for US. CalHFAs first-time home buyer loan programs.

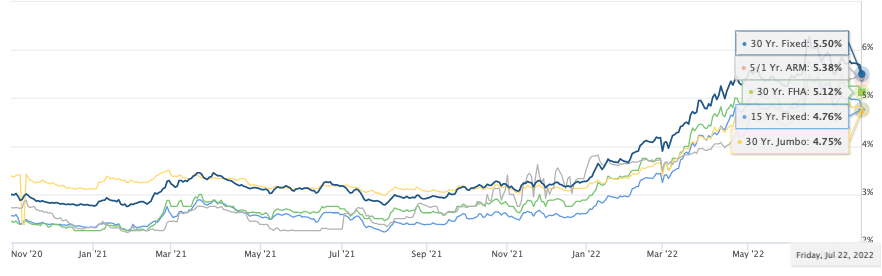

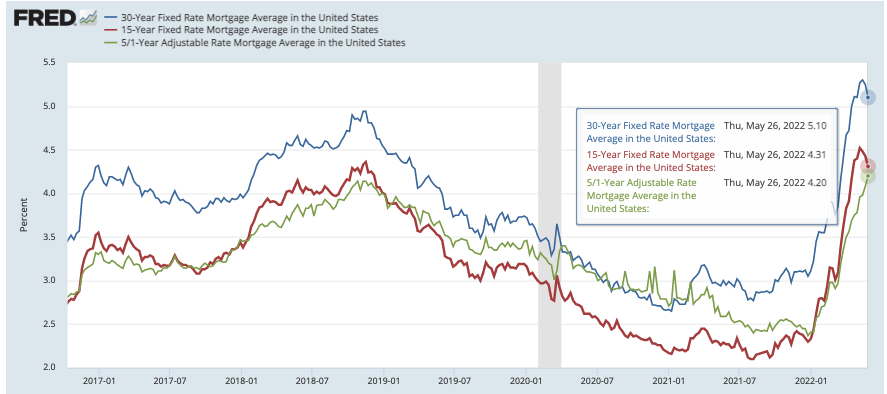

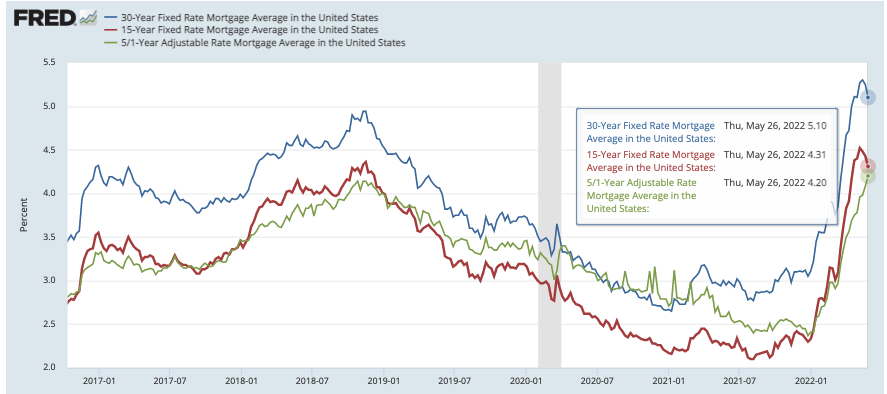

Down payments can range from 3 to 5 for a conventional loan and start at 35 for an. Complete details of 2022 First Time Buyer Programs Florida. Because of this FHA mortgage interest rates may be somewhat higher.

Fannie Maes HomeReady mortgage requires a lower down payment than an FHA loan at 3. So on a 250000 home that would be a 7500 down payment which should be doable for most applicants. An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA.

First-time buyers can take. Use this FHA mortgage calculator to get an estimate. For instance the minimum required down payment for an FHA loan is only 35 of the purchase price.

Refinancing with an FHA loan has some great benefits too. FHA loans are designed for low-to. This loan often works well for first-time homebuyers because it allows individuals to finance up to 965 percent of their home loan which helps to keep down payments and closing costs at a minimum.

You can put down as little as 35. Since CalHFA is not a direct lender our mortgage products are offered through private loan officers who have been approved trained by our Agency. 15-year fixed-rate loans are also available via the FHA program.

About 30-60 business days depending on your lender. In order for a lender to determine whether or not an applicant is eligible for a VA home loan the lender will request a Certificate of Eligibility or COE as its commonly referred to. A Federal Housing Administration FHA loan is a government-backed home mortgage loan with more flexible lending requirements than conventional loans.

FHA loans come in. Visit the Find a Loan Officer tab to contact a loan officer in your area. Three 3 years must have elapsed from the time title transferred.

FHA loans are a good option for first-time homebuyers who may not have saved enough for a large down payment. Steps to prequalify as a first-time home buyer. This program is a 30-year fixed-rate loan.

FHA loans have low down payment requirements. If the foreclosed loan was an FHA loan the 3-year waiting period is based on the date the FHA claim was paid eg. The 203b home loan is also the only loan in which 100 percent of the closing costs can be a gift from a relative non-profit or government agency.

FHA First Time Home Buyer - Apply Online. FHA USDA VA and Conventional HomeReady. If youre looking into buying property as a student keep in mind that your school loans may make getting a mortgage a bit more difficult but the same first-time buyer programs should apply.

An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. The buyer will also have to pay monthly mortgage insurance premiums along with their monthly loan payments. We will use this information to work with you and determine the best options available to you.

FHA loan Insured by the Federal Housing Administration FHA loans allow borrowers to buy a home with a minimum credit score of 580 and as little as 35 percent down or a credit score as low. An FHA Home Loan Specialist will review your information and respond within one business day. Foreclosure 111214 FHA claim dates was 71215 the 3-year waiting period ends 71318.

These loan officers can help you find out more about CalHFAs programs and guide you through the home buying process. FHA and VA loans for example are great options for current students or recent graduates who want to balance their student loan repayments with a mortgage. If youve already got an FHA loan you can refinance with an FHA.

FHA loans are available with fixed or adjustable rates and for 30- or 15-year terms.

Citizens Bank Mortgage Rates 5 43 Review Details Origination Data

Home Loans St Louis Real Estate News

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

Home Loans St Louis Real Estate News

Home Loans St Louis Real Estate News

New Home Fha Loans Home Loans Family Quotes

Home Loans St Louis Real Estate News

30 Year Fixed Mortgage Arthur Hahn Mortgage Loan Originator

Buyers Strike Mortgage Applications Drop 8 Below 2019 As Home Buyers Get Second Thoughts About Raging Mania Wolf Street

Home Buying Tips For Your 20s 30s And 40s Real Estate 101 Trulia Blog

How Much Of A House Do You Typically Own After 10 Years Of A Traditional Fixed 30 Year Mortgage Quora

7 Pieces Of Homebuying Advice You Can T Afford To Ignore Home Buying Home Buying Process Home Buying Tips

Best Marketing Ideas For Realtors Realestate Marketing Real Estate Marketing Pink Door

30 Year Fixed Mortgage Archives Latisha M Elliott Loan Officer

Home Loans St Louis Real Estate News

How Much Of A House Do You Typically Own After 10 Years Of A Traditional Fixed 30 Year Mortgage Quora

Home Loans St Louis Real Estate News